Executive Summary

Private banking faces growing competition from digital-first banks that cater to affluent, tech-savvy clients, the path to growth lies not in product innovation or traditional advertising alone but in creating meaningful, unforgettable client experiences. In a market where digital competitors gain ground by providing seamless digital access, "traditional" banks have a unique opportunity to stand out by offering a distinct blend of convenience, exclusivity, and high-tech / high-touch, personalized service that goes beyond financial products to deliver memorable interactions at every touchpoint.

An experience-centric approach can transform a bank brand into more than a service—it can become a partner in clients’ personal and entrepreneurial journeys. This strategy will build rich legacy and dynamic culture, moving beyond interruptive marketing toward a model where the experience is the marketing.

The vision for transformation is centered on four pillars:

- Marketing/experience as a core growth engine

- Seamless, unforgettable client experiences

- Continuous soft innovation

- Unified brand purpose as a legacy partner

The Case for an experience-centric transformation

1. Addressing market dynamics and client expectations

Rise of digital-first competitors

Digital-native banks attract younger, affluent clients who value seamless, tech-driven experiences. Competitors like Alpian are disrupting the market by catering to the growing demand for convenient, digital banking solutions. Private banks, with its legacy and high-touch service model, has an opportunity to offer the best of both worlds: the ease of digital access coupled with exclusive, high-quality offline interactions (high-touch & high-tech). This combination positions the bank to not only compete but to create a unique experience that digital-first banks cannot replicate.

Beyond product and channel-based marketing

Traditional marketing in private banking has often focused on pushing financial products through dedicated channels, thereby falling into the “acquisition trap.” Today, however, marketing must serve as a cultural driver, permeating every client touchpoint and experience. By transitioning to a model where every interaction feels like an extension of the brand, banks can transform their marketing into a growth engine that unifies and amplifies the brand identity, fostering deep client loyalty.

The end of interruptive marketing

HNW clients are less receptive to interruption-based advertising. Building trusted relationships requires banks to shift from interruptive campaigns to meaningful, integrated engagements. Instead of conventional ads, they can deliver value through thoughtful insights, personalized experiences, and VIP events, positioning itself as a brand that enriches rather than distracts.

2. Defining an experience-centric vision

To truly differentiate, private banks should focus on elevating every aspect of the client journey through an experience-centric approach that aligns with today’s client expectations. This shift will move them from a customer-centric model to one that positions it as an indispensable partner in clients’ wealth and legacy-building journeys.

Marketing/experience as a core growth engine

Position marketing as a strategic driver that’s fully integrated into the client experience, shaping every client interaction as an opportunity to deepen relationships and drive growth.

Seamless, unforgettable client experiences

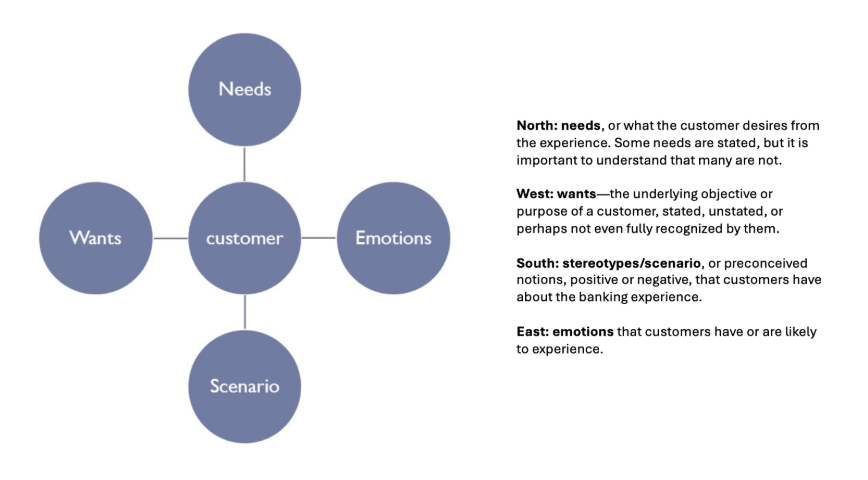

Focus on designing client interactions that feel exclusive and invaluable. This will include both digital and offline experiences that make clients feel understood and respected. To support the creation of these experiences, the bank can turn to the Compass Model drawn from Disney—one approach to understanding different types of customers. The points of the compass help an organization plan a customer-satisfaction program by identifying emotional mind-sets, wishes, and needs.

Unified brand purpose as a legacy partner

Build the bank's brand as a partner in clients’ wealth journeys, with a focus on being a partner for entrepreneurs.

Key strategic pillars and initiatives

1. Experience-centric product development

Reposition marketing as a source of client insights that actively shapes product offerings. This will ensure that the bank's products align with clients’ aspirations and address their unique challenges.

- Example: An invite-only “Entrepreneur Club” providing members with exclusive financial insights, high-level networking opportunities, and customized services for Swiss entrepreneurs.

- Example: A bank-sponsored podcast, "The Entrepreneurial Edge”, where clients are invited as featured guests to share their entrepreneurial journeys, challenges, and successes. This offers clients unparalleled visibility and positions the bank as a unique partner that actively promotes their growth—a service no other bank is providing.

2. Soft innovation: small-scale, meaningful touches

Implement “soft innovation” by focusing on small touches that collectively enhance the client experience. These personalized, memorable touches can differentiate the bank's service offering.

Examples of soft innovation initiatives:

- Milestone celebrations: Send personalized gifts or handwritten notes for important client milestones (e.g., business anniversaries).

- Exclusive events: Host VIP events such as economic outlook seminars with experts or networking dinners.

- Onboarding: Curated welcome package for new clients that includes personalized items (like custom leather portfolio organizers or eco-friendly branded notebooks) along with a personal letter from their advisor.

3. Data-driven personalization

Leverage digital tools, e-banking platform, and CRM data to enable a high level of personalization. This allows banks to deliver client experiences tailored to individual goals, life stages, and business achievements.

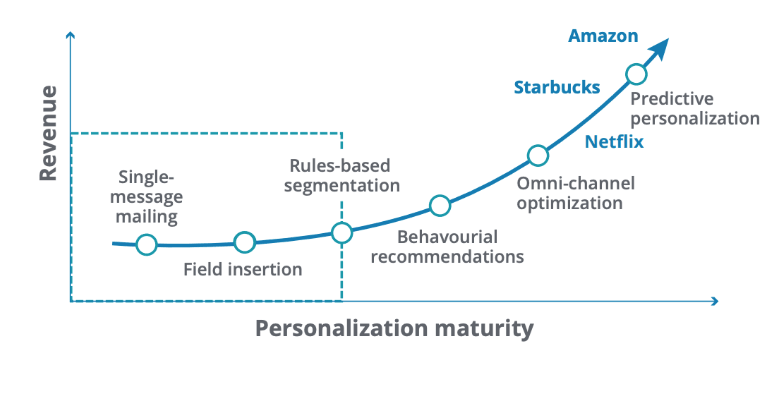

According to a Deloitte’s report, the focus is on creating highly tailored, data-driven interactions to elevate customer experience in today’s dynamic market. With evolving consumer expectations and increased competition, businesses are encouraged to adopt a hyper-personalized approach. Using data and AI, organizations can anticipate customer needs, making interactions more meaningful and fostering loyalty. This hyper-personalization strategy is presented as essential for modern customer engagement, boosting both satisfaction and revenue by ensuring experiences resonate personally with each customer.

4. Continuous experimentation and innovation

Adopt a dynamic, experiment-driven marketing approach to enable quick adaptations based on client feedback. This agile model will foster a reputation for innovation and responsiveness, positioning the bank as forward-thinking and client-focused/satisfaction.

- Example: Transition from annual campaigns to frequent, data-informed iterations, creating a continuous “growth backlog” that combines marketing experiments and product improvements.

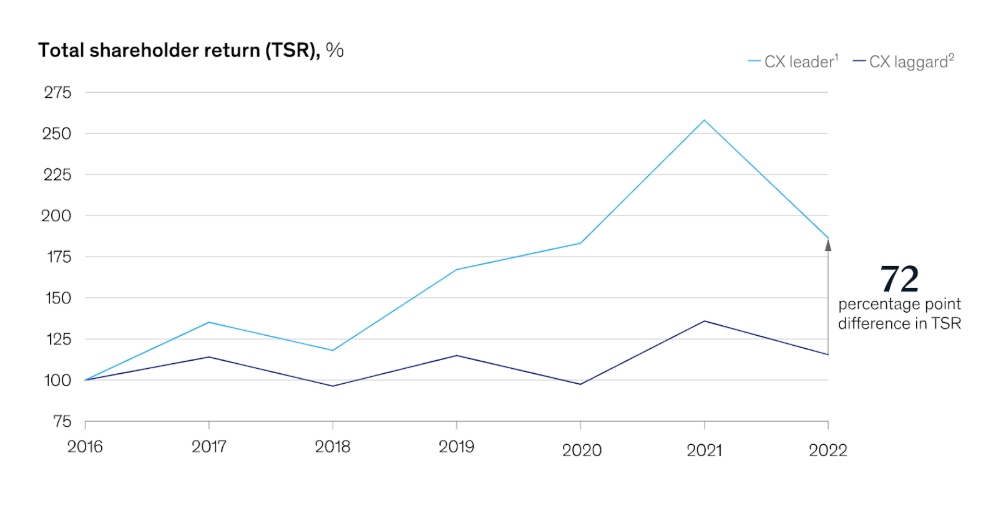

According to a McKinsey research, banks that are frontrunners in customer satisfaction lead in financial metrics such as total shareholder return (TSR), increased growth, and decreased costs. The research also shows a positive correlation between customer satisfaction and purchasing decision—customers who are satisfied with their banking experiences say they will purchase more of that bank’s products.

Measuring success: key performance indicators

To evaluate the growth and impact of an experience-centric approach, Banks needs clear, actionable metrics that reflect client satisfaction, loyalty, and engagement. These KPIs will help monitor how well Banks’ strategy fosters deeper relationships, drives revenue, and differentiates the brand.

By focusing on retention, lifetime value, brand perception, and the pace of innovation, the bank can continuously assess and refine their experience-driven initiatives to ensure they resonate with clients and deliver meaningful, measurable growth.

- Client retention & lifetime value: Track retention rates and lifetime value as indicators of deepening relationships.

- Revenue growth: Monitor revenue growth from both new and existing clients.

- Brand perception: Use client satisfaction surveys (i.e. CSAT, NPS, CES) to evaluate the company’s alignment with its experience-centric vision.

- Innovation velocity: Track the number of soft innovation initiatives completed each quarter and assess their impact on the client experience.

Strategic proposal: introducing a Head of Experience

To lead the transformation toward an experience-centric approach, banks should consider establishing a Head of Experience role. This role has emerged across industries as companies increasingly recognize the need to differentiate through client experiences rather than product features alone. She/he is responsible for aligning the entire organization around a unified client experience strategy, ensuring consistency and quality across all touchpoints.

The growth of this role in today’s corporate hierarchy is not surprising. According to The Economist Intelligence Unit, 59% of companies see their turnover increase faster when they prioritize investment in the customer experience.

To better understand the significance of the Head of Experience role, it’s essential first to consider what defines the customer experience.

“Customer experience encompasses the emotions and perceptions clients develop through their interactions with a company.”

These impressions are shaped by the organization’s staff, services, digital platforms, marketing efforts, and values, as well as its support systems and brand representation.

1. Why a Head of Experience is essential

While traditional roles like the CMO or COO focus on marketing and operational efficiency, respectively, a Head of Experience would bridge these functions, combining aspects of client engagement, brand-building, and operational excellence to create a cohesive, memorable experience for clients.

This role would provide a focused vision for integrating high-tech solutions with high-touch service, ensuring that bank stands out in an increasingly competitive market.

Head of Experience key responsibilities and impact areas

Revenue and market expansion

- Responsibilities: Identify and develop growth strategies that deepen relationships with existing high-value clients while attracting new segments, especially digitally fluent entrepreneurs.

- Impact: Drives revenue by creating experiences that clients value, resulting in higher client retention and increased referrals.

Experience-centric differentiation

- Responsibilities: Lead initiatives that set the bank apart as a pioneer in client experience, emphasizing the balance of digital convenience with exclusive, high-quality personal service.

- Impact: Positions the bank as a leader in private banking by delivering experiences that are difficult for digital-only competitors to replicate.

Brand and reputation building

- Responsibilities: Establish and promote the brand around an unwavering commitment to immersive, exclusive experiences that resonate with clients' values and goals.

- Impact: Builds a distinctive brand reputation that emphasizes the bank's role as more than a bank—a trusted partner in clients’ wealth journeys.

Integrated client experience

- Responsibilities: Ensure consistency across all digital and offline touchpoints, crafting a prestigious, seamless brand experience that resonates with HNW clients.

- Impact: Enhances client satisfaction and loyalty by creating a unified and premium experience at every stage of the client journey.

Purpose and narrative development

- Responsibilities: Position the bank as a trusted advisor in wealth and legacy-building, aligning the brand with Swiss entrepreneurial values.Impact: Elevates the bank’s role from a financial services provider to a legacy partner, appealing to clients seeking long-term impact and legacy.

Conclusion

To remain competitive and redefine its position in the private banking market, banks must embrace an experience-centric transformation that differentiates the brand through seamless, memorable client interactions.

As this strategy unfolds, the Head of Experience would also play a crucial role in aligning employee experience (EX) with client experience (CX). Research shows that a great client experience often starts with an engaged and well-supported workforce.

By closely collaborating with Human Resources, the Head of Experience can ensure that employees receive the same seamless, high-quality experience the bank aims to provide to its clients. This alignment not only fosters a consistent, client-focused culture within the organization but also strengthens competitive edge by creating a mutually reinforcing link between client satisfaction and employee engagement.

With the right leadership and an integrated approach to client and employee experience is set to redefine private banking, transforming it from a series of financial transactions into a series of trust-building, value-driven moments.

***

Sources

McKinsey – Experience-Led Growth: A New Way To Create Value – link

Theodore Kinni – Perfecting the Art of Customer Service, 2nd edition

Seth Godin – Free Prize Inside: The Next Big Marketing Idea (2004)

Deloitte Omnia AI – Connecting With Meaning

McKinsey – Five Ways To Drive Experience-Led Growth in Banking

Nansen – What is Experience-Led Growth?

Harvard Business Review – Why Every Company Needs a Chief Experience Officer

The Economist Intelligence Unit – The Value Of Experience (Genesys Executive Summary)

Wavestone – CX: The Key To Successful Transformation

Gallup – How Employee Engagement Drives Growth