Rebranding Switzerland

Rebranding Switzerland

A case for updating the national narrative and owning the upside

Executive Summary

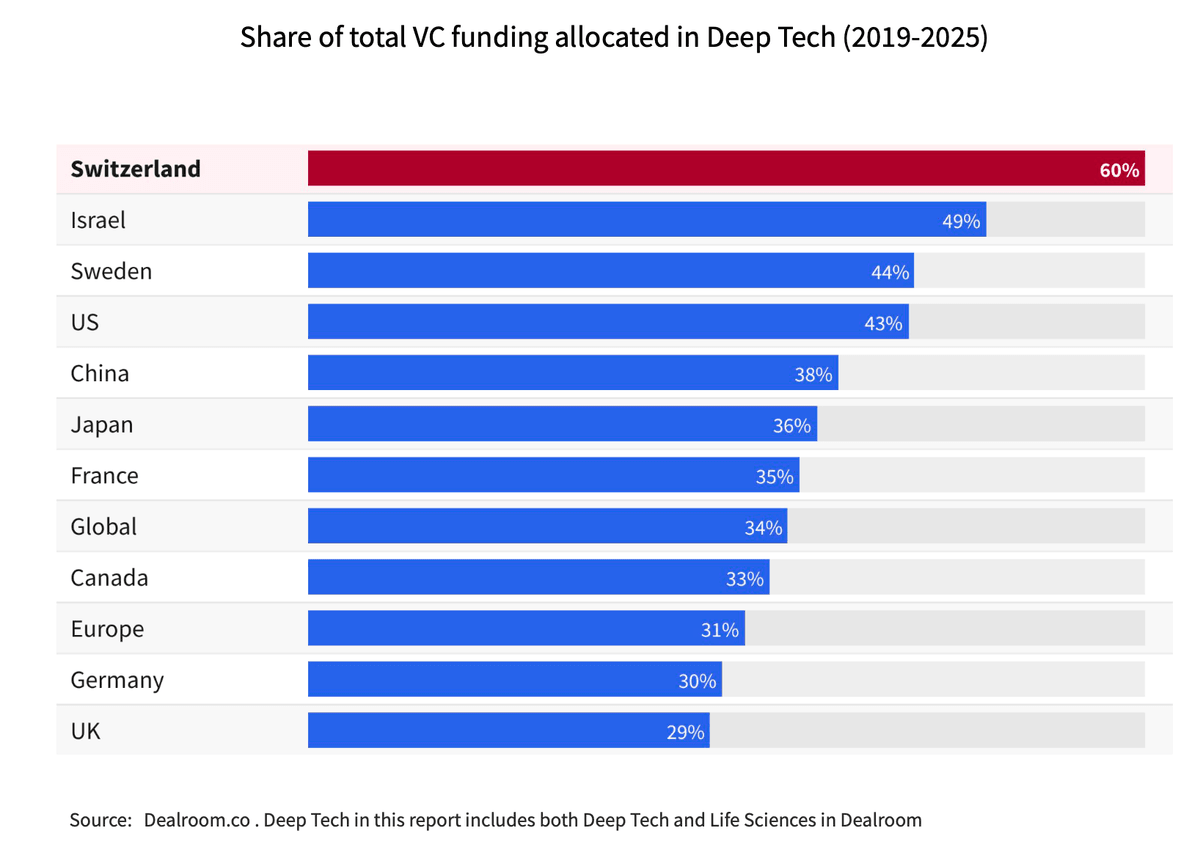

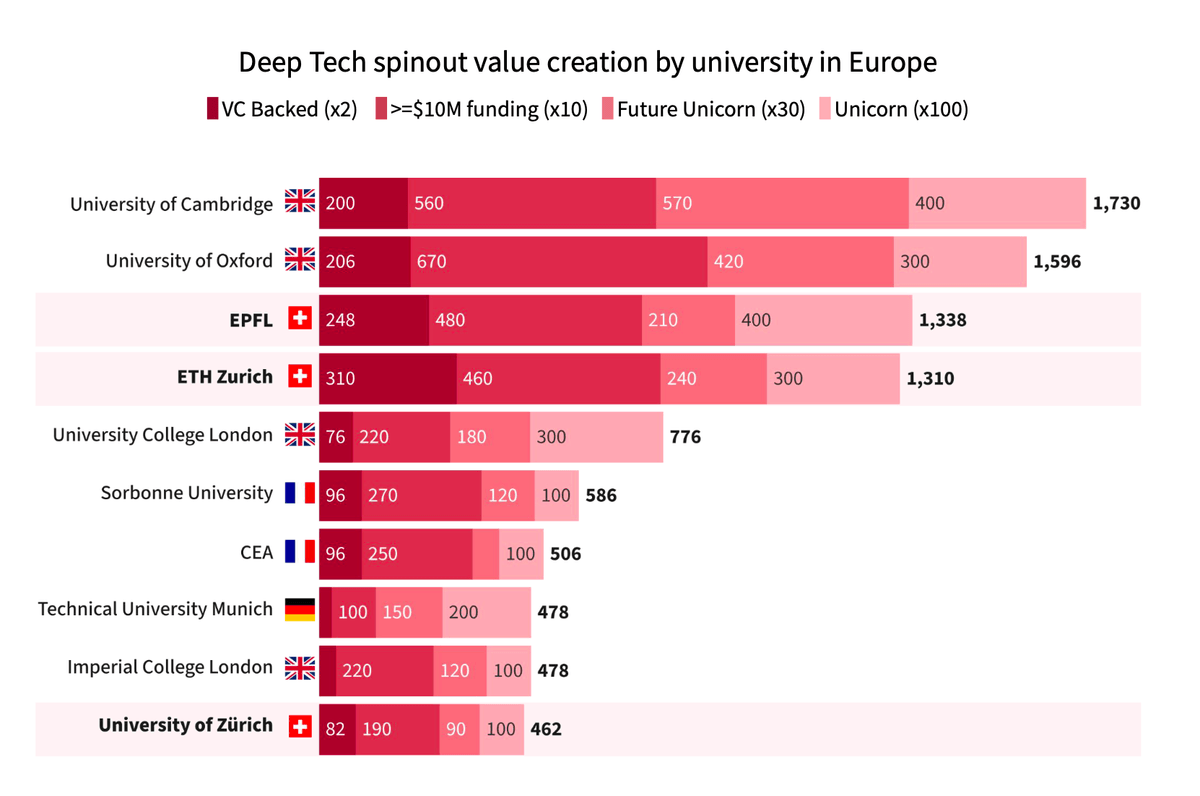

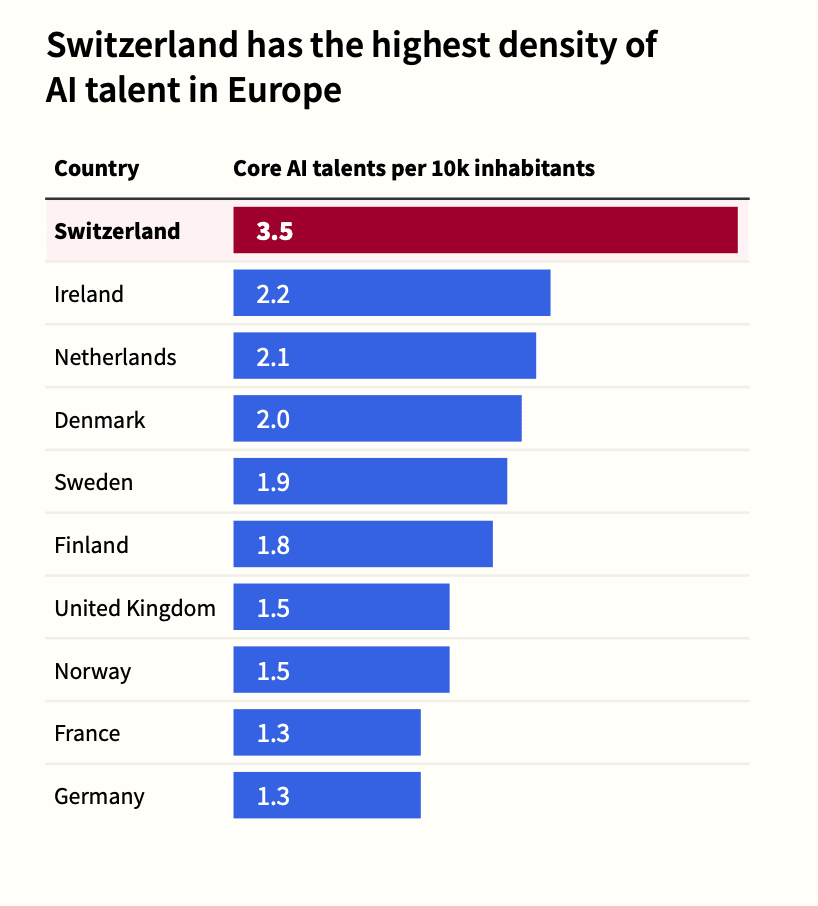

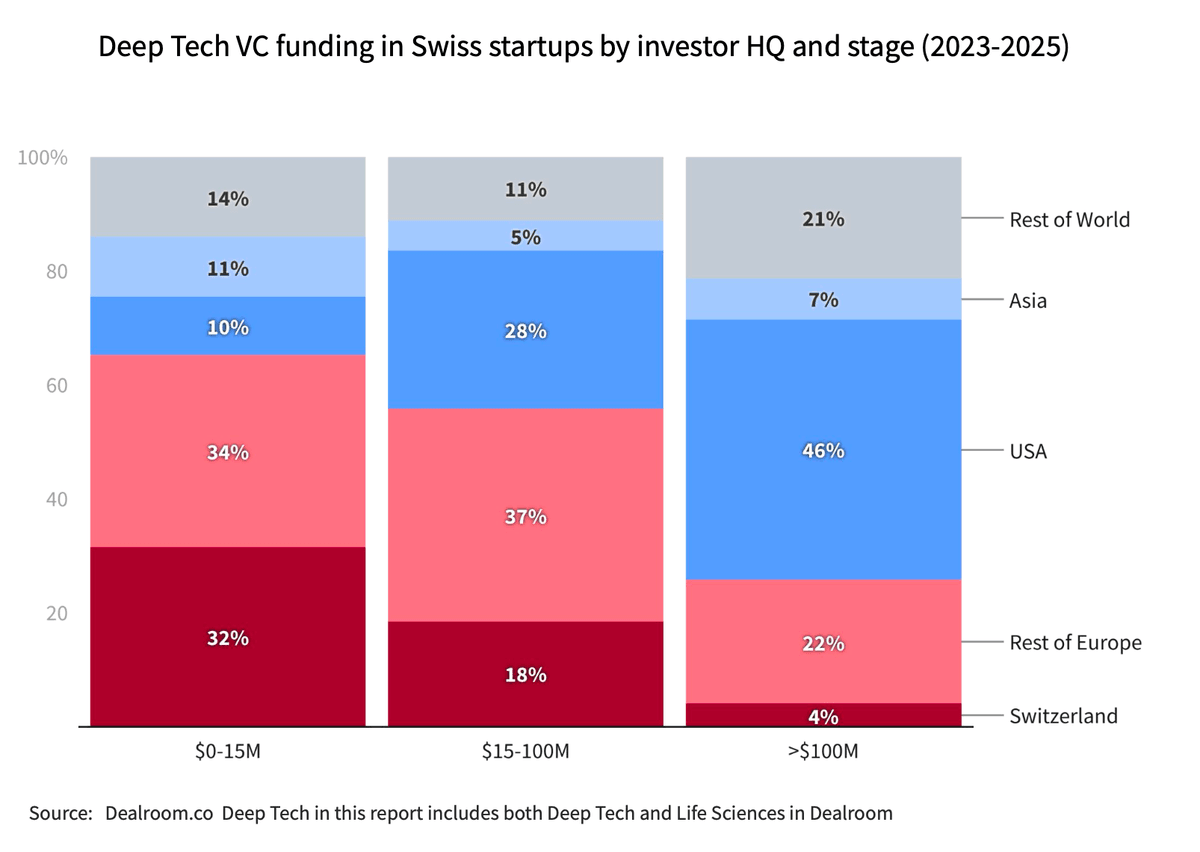

Switzerland’s country brand is world-class but out of date. The world still associates us with chocolate, watches, banks, neutrality, and clean trains. That brand built prosperity in the 20th century. It will not build leadership in the 21st. Today, Switzerland is by the data one of the most concentrated Deep Tech ecosystems on Earth: 60% of domestic VC now flows into Deep Tech (the highest national share globally), Deep Tech funding has grown 6x in a decade, ETH Zurich and EPFL both rank among Europe’s top five for Deep Tech spinout value creation, and Switzerland leads Europe in AI talent density while ranking #1 for innovation for 14 consecutive years. Yet over 85% of Swiss Deep Tech capital is foreign, and domestic participation collapses to 4% in late-stage rounds, exporting narrative power and financial upside.

This is not a startup problem. It is a storytelling and positioning problem. To compete for talent, growth capital, and geopolitical influence, Switzerland must reposition “Swiss Made” from artisanal precision alone to “precision that solves the world’s hardest problems.”

This essays proposes: (1) a national narrative architecture; (2) a three-year activation plan (policy, capital, communications); (3) a measurement framework; and (4) a risk and governance model.

The Gap: Perception vs. Reality

Globally, “Switzerland” still cues safety and quality. It does not cue frontier science commercialisation at scale. Yet the facts are unequivocal:

- Capital intensity: 2019–2025, 60% of Swiss VC went to Deep Tech, the highest share worldwide (ahead of Israel 49%, Sweden 44%, US 43%, China 38%). Per-capita Deep Tech funding ranks #1 in Europe and #3 globally; absolute funding ranks #9. Deep Tech investment rose from c. 2015 to USD 1.9B in 2024 and is pacing ~USD 2.3B in 2025.

- Academic engines: ETH Zurich and EPFL are top-5 in Europe for Deep Tech spinout value creation, producing a steady pipeline of IP-rich companies.

- Talent density: Switzerland accounts for 4.8% of Europe’s core AI talent with only 1.3% of population—Zurich is now an AI powerhouse anchored by global labs and ETH/EPFL.

- System outputs: Private Swiss Deep Tech startups now exceed USD 50B in enterprise value (nearly 20× growth in a decade); adding public and acquired outcomes pushes this beyond USD 100B.

- But financing asymmetry: >85% of Deep Tech VC into Swiss startups is international; domestic investors provide ~⅓ of early-stage capital but drop to ~4% at $100M+ rounds—the world scales what Switzerland builds.

These are nation-brand findings, not just ecosystem trivia. They reveal a brand–reality delta that costs Switzerland talent attraction, capital retention, and geopolitical leverage.

Why Narrative Matters for a Science-Scale Economy

In Deep Tech, perception precedes allocation: doctoral candidates choose labs based on global signals; growth funds write nine-figure checks where they see momentum and story; corporate buyers pilot with companies backed by visible champions; cabinet-level policymakers respond to narratives that connect to national purpose.

Today, Switzerland’s latent advantages:

#1 innovation

#1 patents per capita

top-tier R&D intensity at 3.3% of GDP

Alpine Tech super-cluster scale across Zürich, Lausanne, Geneva, Basel

However, these do not translate into narrative dominance.

Without a modern national story, Switzerland risks becoming the world’s Deep Tech nursery—and everyone else’s growth engine.

What “Swiss Made” Should Mean in 2030

Proposed master position:

Swiss Made = Precision that solves the world’s hardest problems.

Narrative pillars (with proof points):

- Science to Scale – World-leading conversion of academic IP into global ventures (ETH/EPFL top-5 spinout value; consistent $50B+ private EV).

- Trust by Design – Governance, safety, and reliability embedded from chip to clinic (Swiss standards + regulatory credibility; medtech/biotech track record).

- Power-Efficient Intelligence – Leadership in AI hardware, cooling, neuromorphic compute, and applied robotics (SynSense, Corintis, ANYbotics, Sevensense).

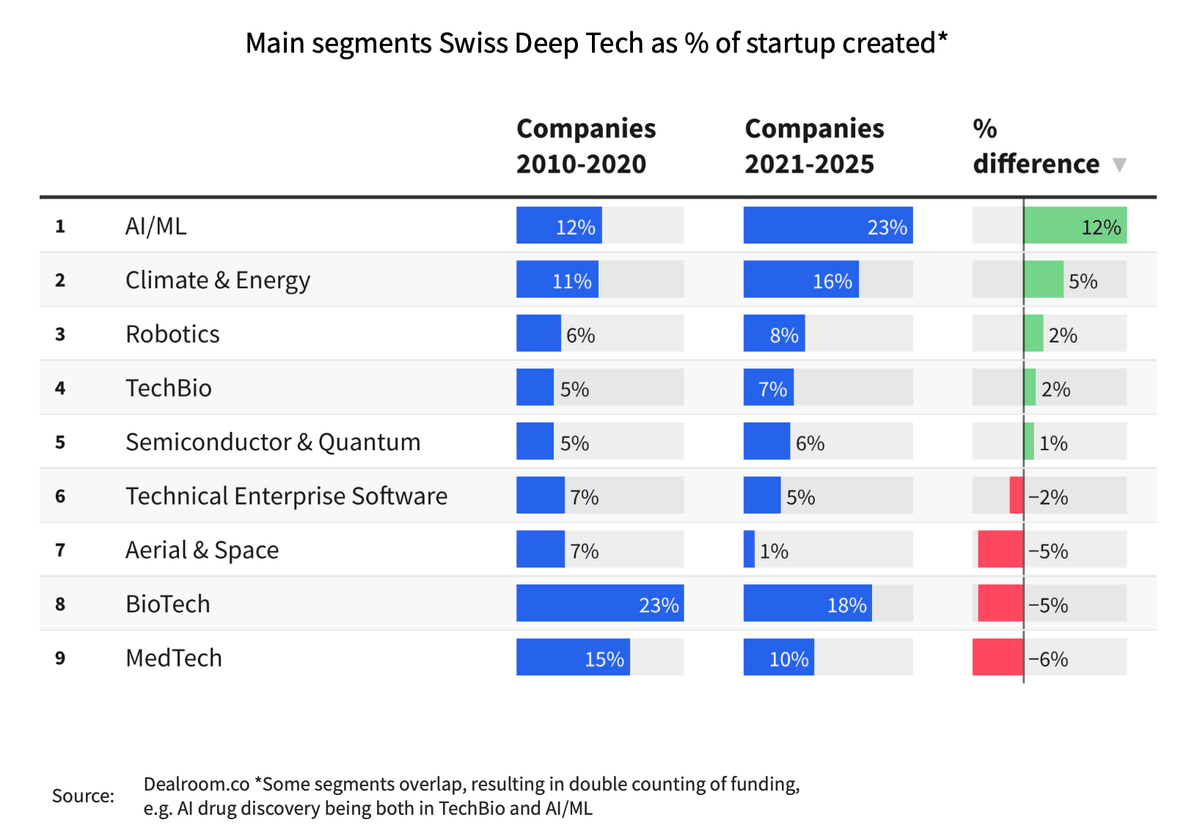

- Climate & Bio Impact – TechBio, DAC, materials, and energy systems that scale (Climeworks et al.; rapid diversification beyond biotech). Place Graph 7 here: “Shift in Swiss Deep Tech Company Formation by Segment (2010–20 vs. 2021–25)”

Communications & Nation Brand

Global Campaign “Swiss Deep Tech Works”

Multi-year, issues-led storytelling (energy efficiency, resilient healthcare, industrial safety). Lead with scientist-founders and deployed case studies; integrate with Präsenz Schweiz channels and Swissnex. Objective: shift SOV (share of voice) in Tier-1 tech/finance media; increase inbound PhD/postdoc interest and late-stage term sheets.

Flagship Annual Report & Roadshow

Institutionalize the Swiss Deep Tech Report as the official narrative spine; deliver minister-level roadshows in Silicon Valley, Boston, London, Berlin, Tel Aviv, Singapore.

Narrative Standards Kit

A reusable “facts & figures” pack (charts, maps, case cards) for embassies, cantons, and universities to ensure message discipline. (This essay can be the master text.)

Capital & Scale

Swiss Growth Co-Investment Window (CH-GROW)

A rules-based, late-stage co-investment program to lift domestic participation from 4% → 15%+ in $100M+ rounds; catalytic capital only, with private lead required. Benchmarks: Bpifrance, British Patient Capital (adapted to Swiss neutrality/competition law).

Spinout Scale Credits

Outcome-based grants redeemable against industrial piloting, verification, and certification for TRL-5→8 transitions in robotics, medtech, and climate hardware.

Sovereign Facilities Fast-Track.

Permitting and grid-access fast track for AI compute, semiconductor packaging, bio-manufacturing, and climate hardware testbeds—paired with energy-efficiency standards.

Talent & Mobility

Frontier Talent Visa

Priority channel for core AI/robotics/semiconductor/bioengineering roles; spouse work rights; multi-entry; research-to-venture bridge.

PhD-to-Founder Tracks.

Expand ETH/EPFL translational fellowships; national stipend for entrepreneurial postdocs; shared IP commercialization playbooks to reduce variance across institutions.

Demand & Procurement

“First Swiss Customer” Framework

Encourage federal/cantonal procurement pilots for qualified safety-critical Deep Tech (inspection robots, water remediation, grid optimisation). Clear liability templates; staged performance gates.

Strategic Buyers Forum

Structured, recurring buyer–startup programming with SBB, Swissgrid, SIG, Flughafen Zürich, Swisscom, Roche/Novartis, ABB, and cantonal utilities to compress sales cycles.

Proof of Momentum (Case Studies)

ANYbotics – Autonomous inspection in hazardous industrial environments; deployed with Shell and Petrobras. Swiss robotics credibility + global customers.

Neural Concept – AI-powered simulation cutting engineering cycles from weeks to minutes; ETH-rooted; applied across mobility and hardware verticals.

Corintis – Advanced chip cooling tackling AI’s energy and thermal bottlenecks; high-impact infrastructure play with Swiss precision hardware.

Sevensense Robotics – Spatial AI enabling autonomous navigation without GPS; foundational tech for mobile robotics in complex spaces.

SynSense – Neuromorphic processors delivering orders-of-magnitude energy gains; Swiss leadership in “power-aware AI.”

Governance, Guardrails & Swiss Specificity

A Swiss rebrand must feel Swiss: pragmatic, evidence-led, consensus-based, fiscally conservative.

- Governance: Federal steering (EAER/SECO) with a small Program Management Office; advisory council with ETH/EPFL, Innosuisse, cantonal reps, and industry (pharma, industrials, utilities, finance).

- Competition & Neutrality: CH-GROW strictly co-investment, price-taking alongside private leads; no picking winners; transparent criteria; avoid distorting seed/Series A markets.

- Standards & Safety: Elevate Switzerland as the global home of trustworthy frontier tech (testing, certification, safety benchmarks), consistent with our brand of reliability.

Measurement: What Success Looks Like by 2030

Capital & Scale

- Domestic share of $100M+ rounds: 4% → ≥15% (rolling 3-year).

- Number of $500M+ “breakout” companies headquartered in CH: +10 net.

Talent

- Core AI/robotics/semiconductor/bioengineering inbound visas issued: +50% vs. baseline.

- PhD-to-Founder transitions (ETH/EPFL + other universities): +40% vs. baseline.

Commercialisation

- TRL-5→8 transitions supported via Spinout Scale Credits: 100+.

- Public-sector “First Swiss Customer” pilots: 50 programs; ≥30 scaled deployments.

Narrative

- Share of voice in top-tier international tech/finance outlets: 2×.

- Global perception shift (annual survey): “Switzerland = Deep Tech leader” top-3 association in target markets.

Conclusion: From Postcards to Prototypes

Switzerland is already a Deep Tech nation by behavior and results. But the world still sees Toblerone. If we do not update the story, others will keep scaling and owning the companies our labs and founders create.

By aligning narrative, capital, and demand, we can convert Switzerland’s quiet excellence into visible, compounding leadership, true to our values and ready for the century ahead.